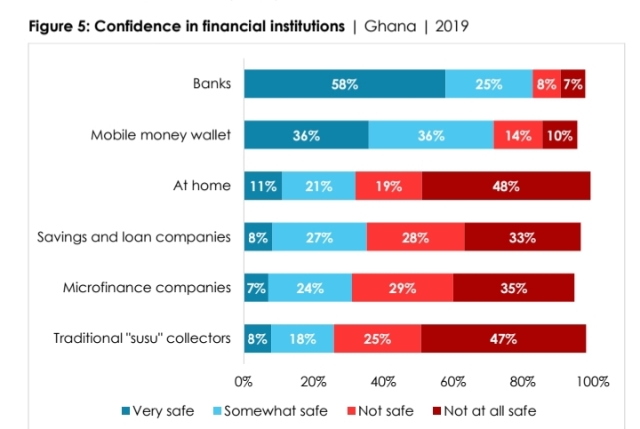

Afrobarometer Report on public confidence in the safety of Ghana's financial institutions, following the clean up in the sector, indicates over 70% of Ghanaians trust mobile money more than other financial institutions.

The report put together by CDD-Ghana noted that in spite of the cleanup, 83% of Ghanaians still trust in banks, but the reputation of savings and loans, microfinance and traditional susu companies has declined considerably.

Only 8% of the 2,400 Ghanaians surveyed said they will save with savings and loans; another 8% trust in traditional susu, while 7% says they still trust microfinance companies.

Meanwhile, some 11% say they would rather keep their money at home instead of saving with any financial institution.

But even though mobile money is about the latest addition to the options in the financial sector, a whopping 72% of respondents say they either trust it fully or trust it somewhat.

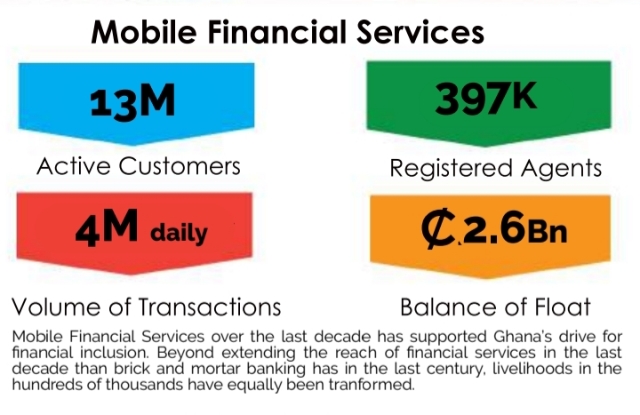

MoMo Stats

Public confidence in Mobile Money is indeed aptly reflected in the subscription, and transaction volume and value figures released by the Telecoms Chamber recently.

The figures indicate that currently, there are 13 million active mobile money wallets, doing 4 million transactions daily, and the balance of cash floating on the mobile money platform is a whopping GHC2.6 billion at any point in time.

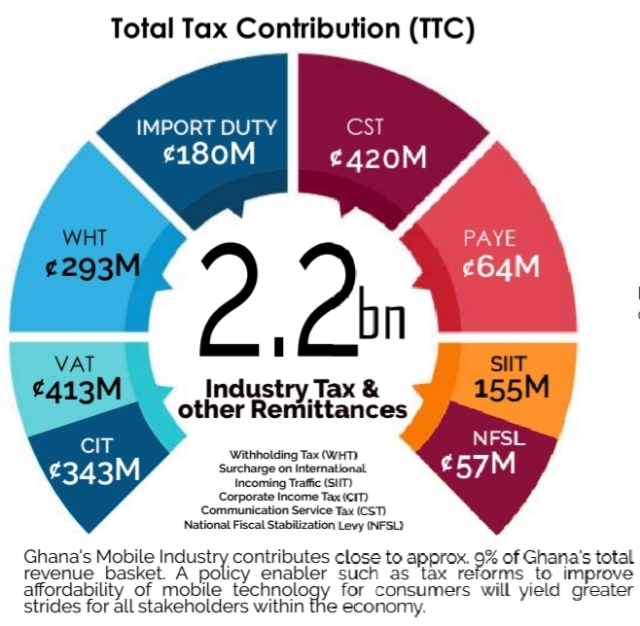

The Chamber also noted that last year alone, telecom operators paid GHC2.2 billion in taxes, and that included taxes on the revenue they make from mobile money services.

Afrobarometer Monitoring and Evaluation Officer at CDD-Ghana, Samuel Adusei Baaye told Adom News Mobile Money is clearly a key driver of financial inclusion and needs to be protected from fraudsters and from over taxation.

He said plans by the Communications Ministry to tax mobile money fees of the telcos is a threat to the growth of the service and its role in boosting financial inclusion.

Samuel Adusei Baaye argued that whatever tax government places on the mobile money earnings of telcos will be transferred to customers and that can discourage usage of the service and thus affect financial inclusion negatively.

MoMo earnings

The Communications Minister, Ursula Owusu Ekuful has said her target is not to burden customers with taxes on mobile money services, but to tax the estimated GHC71 million services charges that telcos earn from mobile money every month.

But she, herself, admitted that her colleague Finance Minister, Ken Ofori- Atta disagrees with her call for the state to tax the earnings of telcos from Mobile Money outside of what they already pay as part of their taxes on all their revenue streams.

The CDD-Ghana official says he agrees with the position of the Finance Minister, because "we are already grappling with the 9% Communications Service Tax (CST) so adding on another tax will not be good for mobilising funds into the financial sector for national development."

He believes the more affordable Mobile Money services are, the higher the potential for it to mobilize more money into the financial sector, which can then be accessed by companies to expand and create more jobs and impact lives directly.

"It is understandable that government needs to find innovative ways to generate revenue for development, but taxing mobile money earnings of telcos in addition to what they already pay would only affect customers in the long run and make the country lose the financial inclusion battle," Samuel Adusei Baaye said.

Source: Myjoyonline.com